This is made possible by our legal and administrative expertise and by our extensive network of reliable, hand-picked partners of Immigration Lawyers, Consultants, Realtors, Business Planners & More

- Call us: +1-416-700-7091

- contact@sixxermigrate.com

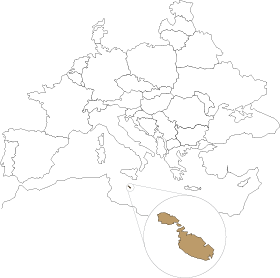

Although one of the smallest countries in the world, Malta offers some of the biggest opportunities — from a thriving economy that is highly diversified in multiple sectors, including financial services, high-value manufacturing, and tourism; as well as being a natively English-speaking member of the European Union and the Eurozone. Located in the central Mediterranean Sea, Malta’s strategic position plays an important role in its attraction to both visitors and investors eager to discover the many hidden gems of this remarkably picturesque and globally-acclaimed island.

As an EU member since 2004, Malta is often considered the gateway to the Euro-Mediterranean region and has become an excellent choice for investment due to its stable political climate, growing economy, and booming tourist property market. It also has some of the most reputable banks in the world — creating an optimal environment for investors looking to diversify their portfolio and seize opportunities worldwide:

Malta Exceptional Investor Naturalization (MEIN) offers citizenship in a highly respected EU member country to high-net worth individuals and their families who contribute to the nation’s economic and social development, and provides the following exclusive benefits:

To qualify for Malta’s Exceptional Investor Naturalization (MEIN), applicants must carry out an exceptional direct investment in Malta in accordance with the Regulations, and meet the following criteria:

The following family members qualify as dependents of the main applicant:

To qualify for citizenship, the main applicant must provide proof of residence in Malta, and fulfill the following contribution requirements.

Exceptional Contribution

All individuals and families applying for Malta economic citizenship must make a significant non-refundable investment in the National Development and Social Fund (NDSF) set up by the Government of Malta:

Real Estate Investment

In addition to the prescribed contribution, the main applicant must either acquire a property in Malta worth at least €700,000 or rent one for at least €16,000 per annum for a minimum period of 5 years from the date of issuance of the Certificate of Naturalization.

Government Donation

Following the approval in principle, applicant must donate at least €10,000 to a local non-profit organization.

The applicant can choose from numerous qualified philanthropic, artistic, sport, scientific, or cultural non-governmental organizations (NGOs) and societies registered in Malta.

All application fees issued by the government of Malta and by Arton may be subject to change. Fees depend on the number of applicants and the complexity of the process

RESIDENCY STAGE FEES

ELIGIBILITY STAGE FEES

CITIZENSHIP STAGE FEES

Payment of additional due diligence, residence card issuance, and other administrative fees may apply.

The United Arab Emirates has three pathways to company registration: mainland for global trading, free zone for 100% foreign ownership in the free zone, and offshore for tax optimization.

A mainland company is nothing but an onshore company which is registered under the government authority of the concerned emirate. The trade license is issued by the Department of Economic Development of the particular emirate. A UAE mainland company is mainly characterized by the liberal trading conditions. Unlike the other two types of companies, a mainland company has the advantage of receiving authorization to trade both on the UAE local market and outside the UAE.

A free zone company is a company formed within a special economic area within an emirate where goods and services can be traded. There are more than 40 free zones operating in the UAE. Free zones have their own regulations and have a government regulatory body called the Free Zone Authority. The Free Zone Authority is in charge of trade license issuance. A UAE free zone is characterized by the benefits of 100% foreign ownership and tax concessions. A free zone company is authorized to trade between businesses in and outside of the UAE.

An offshore company is a business entity that is set up with the intention of operating outside its registered jurisdiction and/or the location of its ultimate ownership. A company may legitimately move offshore for the purpose of tax optimization or to enjoy more suitable regulations.

Establishing a company in any part of the world can be challenging – with a multitude of available jurisdictions in the UAE alone, how do you know which one works for you?

While this can depend on several factors like your business activity, company structure, and the necessity of a physical office space, our seasoned business setup consultants take away the hassle with personalized solutions that cater to your unique business needs.

Here are some of the best jurisdictions in the UAE:

For businesses wishing to operate in Dubai and expand across the UAE, the Department of Economic Development Dubai Mainland enables direct trade with customers, other mainland businesses, and the provision of essential services from the government of Dubai.

A globally recognized and strategically located freezone, DMCC is ideal for corporate businesses that require a physical presence. With more than 19,000 companies registered to date, DMCC is a trade and enterprise center for commodities.

Best known for its world-class port and close proximity to major markets, Jebel Ali Free Zone is an economic trade hub for industrial businesses that require warehouse spaces and logistics infrastructure

Meydan Freezone is the place to be for freelancers and start-ups. With numerous competitive licensing options, this freezone provides a vast support system to new and emerging businesses entering the UAE market.

RAK ICC is one of the world’s fastest growing corporate registries. For businesses looking to setup an offshore operation in the UAE, RAK ICC offers the most time-efficient and cost-effective solution.

In addition to the business setup options which give foreigners short-term residency status, the Government of UAE has also established a successful long-term residency program. The UAE Golden Visa for investors in public projects and real estate secures 10-year visa for qualifying applicants

The minimum investment requirement is AED2M in the form of:

In some cases, there is a minimum mandatory holding period and restrictions to use loans for the investment.

Benefits :

All application fees charged by the UAE government are subject to frequent change. These fees depend on the jurisdiction type, license activity and complexity of the process.

Contact us to get precise quote based on your needs and preferences.

Compare the different programs side by side and examine their features.

Find out the cost estimates for each program tailored to your family.

See the power of global mobility for each passport.

The Arton Index is an overall assessment andcomparative benchmark of the country and its investmentprogram.

Population growth 0.33%

GDP (per capita)

GDP (purchasing power parity)

26 billion USD

Visa free countries

LOCATION

Southern Europe, islands in the Mediterranean Sea, south of Sicily

CAPITAL

Valletta

DIFFERENCE

UTC – 1

TOTAL AREA

316 km2

AGE DEMOGRAPHICS

0-14: 14.29%, 15-24: 11.03%, 25-54: 40.92%, 55-64: 13.25%, 65+: 20.51%

LANGUAGE

Maltese (official): 90.1%, English (official): 6%, Multilingual: 3%, Other: 0.9%

RELIGIONS

Roman Catholic (official): More than 90%

GOVERNMENT TYPE

Parliamentary republic

CURRENCY

Euro (EUR)

EXCHANGE RATE

1 USD = 0.885 EUR

338 Queen St E # 207, Brampton, ON L6V 1C4, Canada