This is made possible by our legal and administrative expertise and by our extensive network of reliable, hand-picked partners of Immigration Lawyers, Consultants, Realtors, Business Planners & More

- Call us: +1-416-700-7091

- contact@sixxermigrate.com

Saint Lucia is the newest and arguably the best-positioned citizenship by investment program in the Caribbean. Vibrant, discerning and alluring, Saint Lucia offers all the tropical benefits of the region while being exclusive, authentic and engaging.

Saint Lucia has inherited decades of experience from its Caribbean neighbors. By hand-picking only the best practices, the Citizenship by Investment Board is committed to making the program the most efficient for investors while providing unmatched benefits for the country and its people.

Saint Lucia recognizes dual citizenship, which can prove advantageous for business expansion and tax relief.

Other benefits including the following:

Saint Lucia’s Citizenship by Investment Program was established in 2015 under the regulations of the Citizenship by Investment Bill 2015, making it the most recent addition to the citizenship by investment programs in the Caribbean region.

To qualify for citizenship in Saint Lucia, applicants must fulfill one of the investment options in addition to meeting the following criteria:

The following family members qualify as dependents of the main applicant:

National Action Bond

Upon approval, applicants with any number of dependents may invest US$300,000 in non-interest- bearing government bonds. The bond must be held for a minimum period of 5 years, and a non-refundable government administrative fee of US$50,000 per application is payable once citizenship has been granted.

National Economic Fund Contribution

High net worth individuals may choose to make a monetary contribution to the NEF organization via one of the prescribed contribution options:

Applicants may purchase a property for a minimum of US$200,000 in a pre-approved real estate development area. The property must be owned and maintained for a minimum of five years. Property registration, processing fees and taxes must be paid in addition to the property purchase.

Under this option, applicants may invest in projects that aim to enhance the country’s infrastructure under approved development categories.

An additional, non-refundable administration fee of US$50,000 will apply to each of the above options

Arton’s Advisory fees are based on the number of dependents, country of origin, residence and other retained services, as well as service and legal fees related to the submission of citizenship and passport application for the main applicant. The advisory fees are non- refundable and are payable in two equal installments.

All application fees charged by the government of Saint Lucia and by Arton are subject to change. These fees depend on the number of applicants and the complexity of the process. Please contact us if you have any questions or need more information.

Applicants and their families must also pay the following non-refundable fees depending on the size of the family and the chosen investment option:

GOVERNMENT ADMINISTRATION FEES (REAL ESTATE /ENTERPRISE)

GOVERNMENT FEES (BONDS)

PROCESSING FEES

DUE DILIGENCE FEES

The United Arab Emirates has three pathways to company registration: mainland for global trading, free zone for 100% foreign ownership in the free zone, and offshore for tax optimization.

A mainland company is nothing but an onshore company which is registered under the government authority of the concerned emirate. The trade license is issued by the Department of Economic Development of the particular emirate. A UAE mainland company is mainly characterized by the liberal trading conditions. Unlike the other two types of companies, a mainland company has the advantage of receiving authorization to trade both on the UAE local market and outside the UAE.

A free zone company is a company formed within a special economic area within an emirate where goods and services can be traded. There are more than 40 free zones operating in the UAE. Free zones have their own regulations and have a government regulatory body called the Free Zone Authority. The Free Zone Authority is in charge of trade license issuance. A UAE free zone is characterized by the benefits of 100% foreign ownership and tax concessions. A free zone company is authorized to trade between businesses in and outside of the UAE.

An offshore company is a business entity that is set up with the intention of operating outside its registered jurisdiction and/or the location of its ultimate ownership. A company may legitimately move offshore for the purpose of tax optimization or to enjoy more suitable regulations.

Establishing a company in any part of the world can be challenging – with a multitude of available jurisdictions in the UAE alone, how do you know which one works for you?

While this can depend on several factors like your business activity, company structure, and the necessity of a physical office space, our seasoned business setup consultants take away the hassle with personalized solutions that cater to your unique business needs.

Here are some of the best jurisdictions in the UAE:

For businesses wishing to operate in Dubai and expand across the UAE, the Department of Economic Development Dubai Mainland enables direct trade with customers, other mainland businesses, and the provision of essential services from the government of Dubai.

A globally recognized and strategically located freezone, DMCC is ideal for corporate businesses that require a physical presence. With more than 19,000 companies registered to date, DMCC is a trade and enterprise center for commodities.

Best known for its world-class port and close proximity to major markets, Jebel Ali Free Zone is an economic trade hub for industrial businesses that require warehouse spaces and logistics infrastructure

Meydan Freezone is the place to be for freelancers and start-ups. With numerous competitive licensing options, this freezone provides a vast support system to new and emerging businesses entering the UAE market.

RAK ICC is one of the world’s fastest growing corporate registries. For businesses looking to setup an offshore operation in the UAE, RAK ICC offers the most time-efficient and cost-effective solution.

In addition to the business setup options which give foreigners short-term residency status, the Government of UAE has also established a successful long-term residency program. The UAE Golden Visa for investors in public projects and real estate secures 10-year visa for qualifying applicants

The minimum investment requirement is AED2M in the form of:

In some cases, there is a minimum mandatory holding period and restrictions to use loans for the investment.

Benefits :

All application fees charged by the UAE government are subject to frequent change. These fees depend on the jurisdiction type, license activity and complexity of the process.

Contact us to get precise quote based on your needs and preferences.

Compare the different programs side by side and examine their features.

Find out the cost estimates for each program tailored to your family.

See the power of global mobility for each passport.

The Arton Index is an overall assessment and comparative benchmark of the country and its investment program.

Population growth 0.31%

GDP (per capita)

GDP (purchasing power parity)

22.542 billion USD

Visa free countries

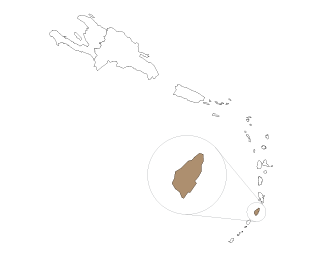

LOCATION

Caribbean, island between the Caribbean Sea and North Atlantic Ocean, north of Trinidad and Tobago

CAPITAL

Castries

DIFFERENCE

UTC -4

TOTAL AREA

616 km2

AGE DEMOGRAPHICS

0-14:19.77%, 15-24: 14.79%, 25-54: 42.93%, 55-64: 10.41%, 65+: 12.11%

LANGUAGE

English (official), French Patois

RELIGIONS

Roman Catholic: 61.5%,

Protestant: 25.5%,

Other Christian: 3.4%,

Other: 9.6%

GOVERNMENT TYPE

Parliamentary democracy under a constitutional monarchy and a Commonwealth realm

CURRENCY

East Caribbean dollars (XCD)

EXCHANGE RATE

1 USD = 2.7 XCD

338 Queen St E # 207, Brampton, ON L6V 1C4, Canada